Portfolio management remains one of the most complex, judgment-heavy areas of financial operations. Despite technological progress, many investment research and decision-support workflows remain manual and non-scalable, constrained by legacy systems and human bandwidth.

Today’s asset management firms face twin pressures, deliver higher performance at speed while maintaining governance and regulatory rigor. Traditional automation and rule-based RPA can optimize routine tasks but fall short in dynamic, data-intensive, and analytical contexts such as portfolio construction, risk modeling, and trade reconciliation.

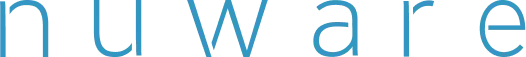

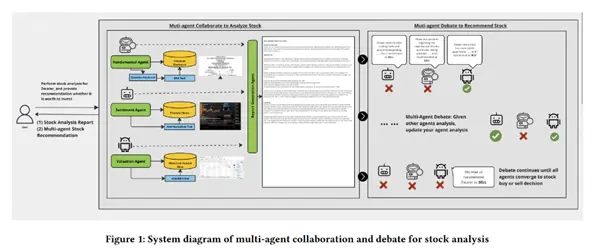

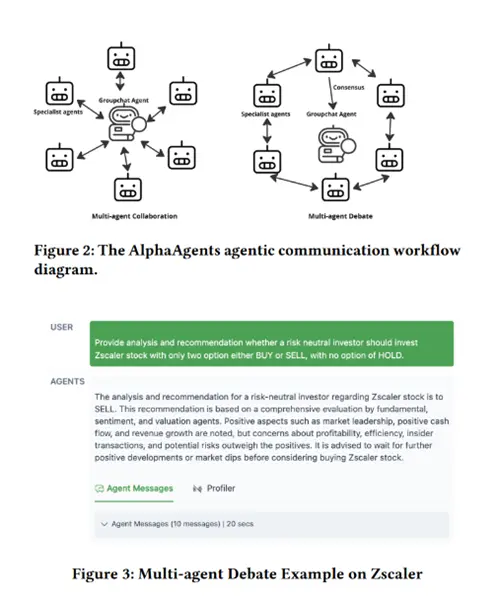

This is where agentic AI automation; a new class of intelligent, self-orchestrating systems, becomes transformative. Not as a replacement for analysts or quants, but as an extension of portfolio intelligence, blending machine learning, NLP, and governance frameworks to create a responsive, explainable, and scalable ecosystem.

NuWare partnered with a global asset management firm to design and deploy such a solution, an AI-augmented, agentic automation framework tailored for portfolio management workflows, delivering speed, accuracy, and compliance at enterprise scale.